tax deductions for high income earners 2019

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Most legal ways of avoiding tax involve you spending money and claiming a.

How Do Marginal Income Tax Rates Work And What If We Increased Them

2020 Contribution Limit.

. Lets start with retirement accounts. Common Schedule 1 deductions for 2021 are. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

Previously called above-the-line tax deductions taxpayers can take certain deductions on the 1040 Schedule 1 form. Social Security will withhold 1 from benefits for each 3 earned over that limit until the month the worker. One of the best ways for high earners to make charitable contributions is to establish a donor-advised fund.

The amount is 5000 for married taxpayers filing separate returns. Under reasonable assumptions about behavioural responses to taxation the Laffer curvewhich shows the relationship between the tax rate and tax revenuespeaks around 60-75 percent for high. The earnings limit for people turning 66 in 2019 will increase from 45360 to 46920.

Your income places you in the 35 in the IRS 2022 tax bracket. But for many high earners they are unable to fund Roth IRAs due to income limits. Tax deductions lower the amount of your income that will be subject to taxation.

Tax deductions for high income earners 2019 Saturday February 12 2022 Edit. In the short run high marginal tax rates induce tax avoidance and tax evasion and can cause high-income earners to reduce their work effort or hours. This allows you to do the same annual contributions as.

Standard deduction of 24000 Fourth Year. Income splitting and trusts. Itemized deduction of 60000 50000 charitable giving 10000 SALT Third Year.

Sell Inherited Real Estate. Australians earning over 27k. The annual contribution limits are a little bit lower though 13000 in 2019 or add another 3000 if youre 50 and older so you have a 16000 annual contribution limit.

Another tax reduction strategy for high income earners that is not yet fully understood by a lot of people is selling off inherited real estate. Max Out Your Retirement Contributions. Contributions now phase out at 124000 and 139000 of modified adjusted gross income.

For example you have until April 15 2020 to make your 2019 contributions. Employer-based accounts such as 401 k and 403 b accounts allow you. When you inherit real estate particularly states with community property rules you get a full step up in basis making your property tax go up.

The law limits the deduction of state and local income sales and property taxes to a combined total deduction of 10000. Long-term capital gains tax rates are zero 15 percent and 20 percent for 2018 depending on your income. In Georgia however the deduction is.

High-net-worth individuals that have self-employment income and its only you or you and your spouse can set up a Solo 401k. Standard deduction of 24000 Second Year. Tax deductions you may want to maximize.

In 2018 you can contribute up to 5500 to one or more traditional or Roth IRA s -- in total. Tax deductions are the permitted expenses meant for reducing taxable income as well as tax liability. Contrast this to a worker earning 10200 per year.

50 Best Ways to Reduce Taxes for High Income Earners. In 2019 that rises to. Theyre contributing 1300 to their retirement account.

196000 to 206000 if youre married filing jointly The limits on deducting long-term care premiums also increased to 5430 per person for those ages 71 or over and 4350 for those ages 61 to 70. Contributions are tax-deductible the money grows tax-free and withdrawals are tax-free for qualified medical expenses for those under age 65 and for any purpose if you are age 65 or over. Selling Inherited Real Estate.

State and local taxes. If youre 50 or older the limit is 6500. 9 Ways for High Earners to Reduce Taxable Income 2022 1.

For 2018 you cannot fund a Roth IRA if your income. You may take an itemized deduction for contributions of money or property to a tax-qualified charity. Taxpayers can deduct the part of their medical and dental expenses thats more than 75 percent of their adjusted gross income.

In the 10 tax bracket theyd save about 130. The Tax Cuts and Jobs Act the tax reform legislation passed in December made major changes to the tax law including. It would look like the following.

You can make contributions for the calendar year up until the tax filing deadline for that year. Itemized Deduction of 60000. You can deduct up to 60 percent of your adjusted gross income each year for gifts of money.

The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. A donor-advised fund is like a charitable investment account. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their withholding soon to avoid an unexpected tax bill or penalty when they file their 2018 federal income tax return in 2019.

Your tax savings will therefore be around 1400. Additional catch-up contribution if youre 50 or older on the last day of the year. Federal tax brackets on wages go from 10 percent for the lowest earner to 37 percent for.

For example if your income is 80000 and you have 20000 worth of tax deductions your taxable income is 60000.

Who Pays U S Income Tax And How Much Pew Research Center

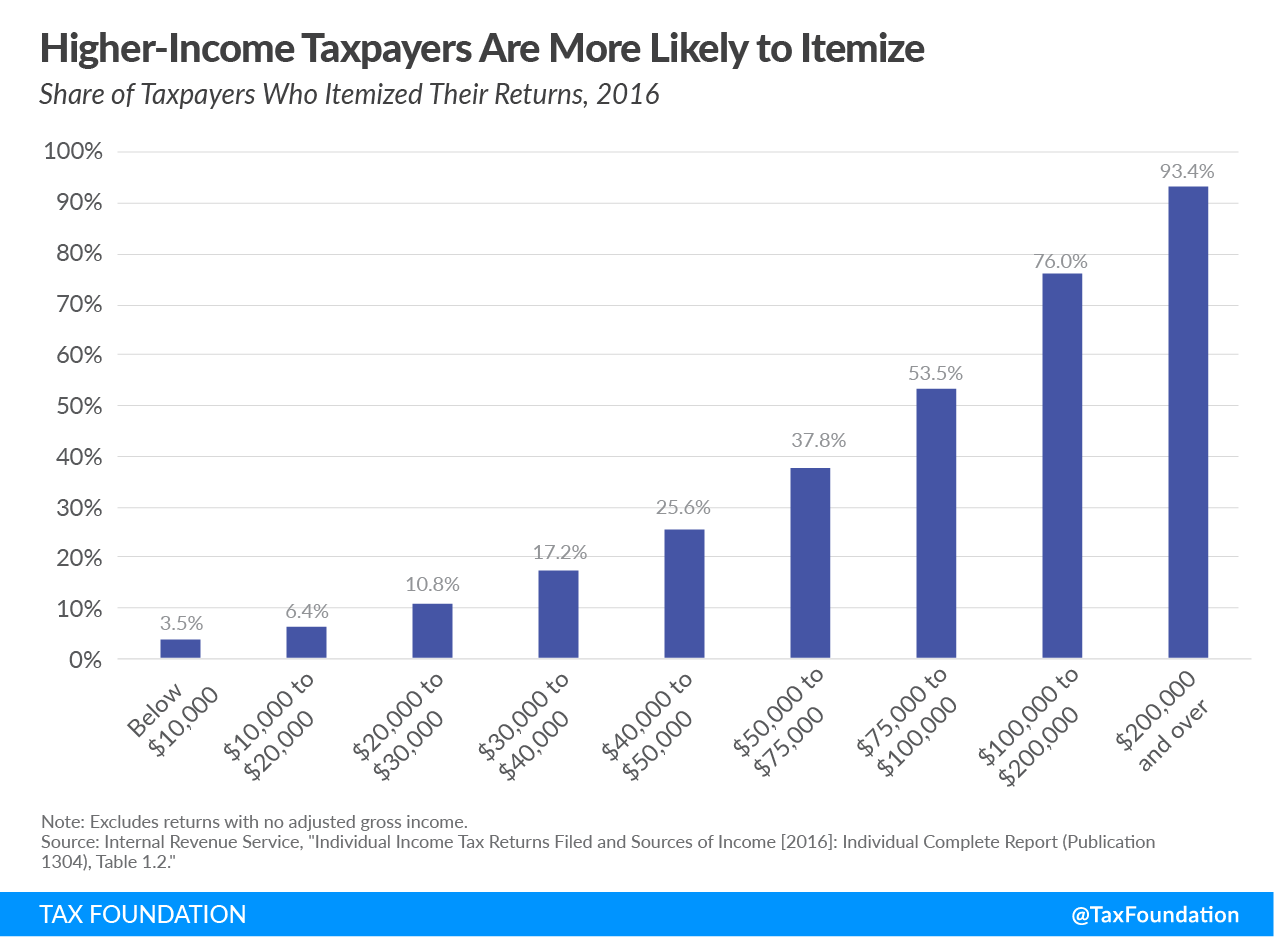

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The 4 Tax Strategies For High Income Earners You Should Bookmark

How Do Marginal Income Tax Rates Work And What If We Increased Them

5 Outstanding Tax Strategies For High Income Earners

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Who Benefits More From Tax Breaks High Or Low Income Earners

How Fortune 500 Companies Avoid Paying Income Tax

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

Tax Strategies For High Income Earners Wiser Wealth Management

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

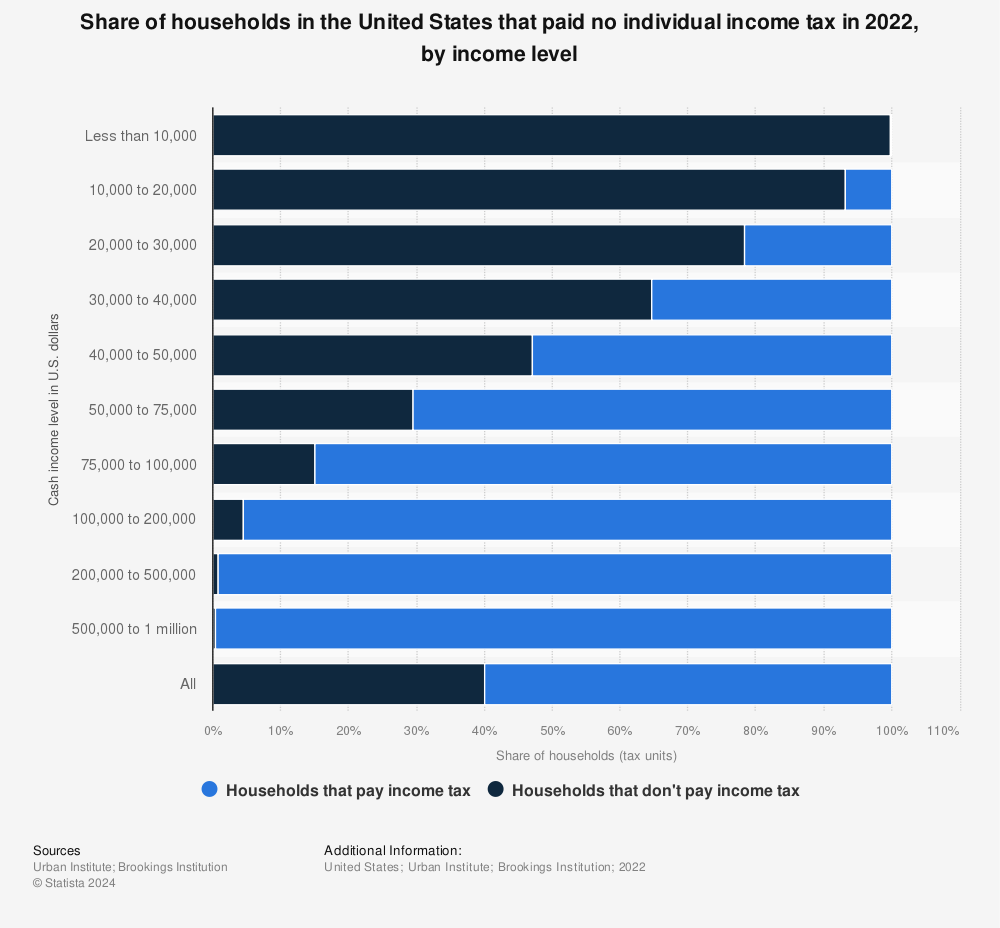

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)